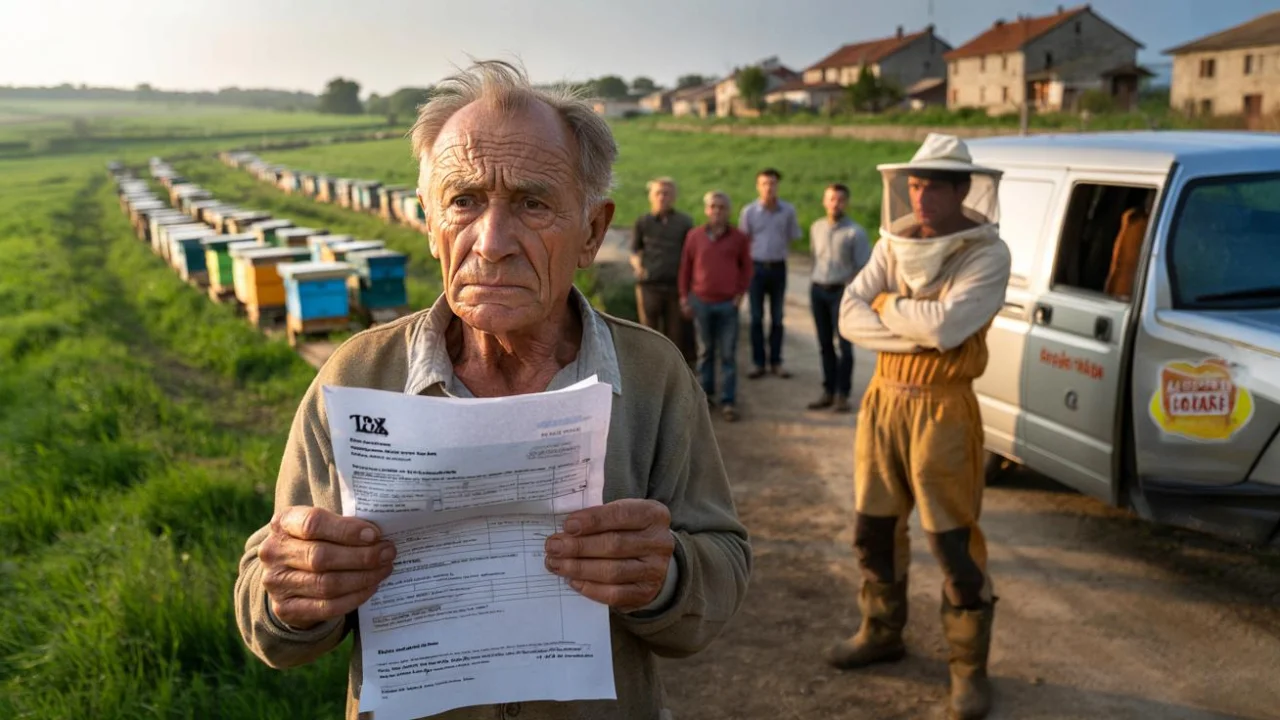

Robert stared at the tax bill in disbelief. Three years ago, he’d felt proud helping his neighbor Tom place a dozen beehives on his unused acre behind the house. It seemed like the perfect retirement gesture – supporting local honey production while keeping his family land productive. No money changed hands, just a handshake and Tom’s promise of fresh honey each season.

Now the tax office was demanding $8,400 in back payments and penalties. His land had been reclassified for agricultural use without his knowledge. Worse, Tom had stopped returning his calls and the whole neighborhood was taking sides. What started as a friendly favor had become Robert’s biggest retirement nightmare.

This exact scenario is playing out in rural communities across the country, turning retirees’ good intentions into costly tax traps and destroying lifelong friendships.

How Agricultural Land Tax Rules Turn Friends Into Enemies

The agricultural land tax system doesn’t care about your good intentions. When you allow someone to use your property for commercial farming activities – even beekeeping – the tax authorities see potential income generation, not neighborly kindness.

“Most landowners have no idea they’re creating a taxable situation,” explains rural tax consultant Jennifer Martinez. “The moment those hives start producing honey for sale, your ‘unused’ land becomes part of a business operation in the eyes of the IRS.”

Here’s what typically happens: A beekeeper approaches landowners offering to place hives for “environmental benefits.” No formal agreements get signed. The landowner assumes it’s purely charitable. Meanwhile, the beekeeper operates a legitimate business, selling honey and renting out hives for crop pollination.

When tax authorities discover the arrangement – often through aerial surveys or municipal records – they reclassify the land use. Suddenly, property that qualified for residential or unused land rates gets hit with commercial agricultural assessments, including retroactive penalties.

The Hidden Costs That Destroy Retirement Dreams

The financial impact extends far beyond simple tax adjustments. Property owners face a cascade of unexpected expenses that can drain retirement savings:

- Retroactive tax assessments often going back three to five years

- Penalty fees for unreported agricultural income or land use changes

- Legal costs when disputes escalate between landowners and beekeepers

- Property insurance adjustments for commercial agricultural activities

- Zoning compliance fees if agricultural use violates local ordinances

But the emotional toll often proves worse than the financial damage. Communities that once celebrated local honey production now split into bitter factions when tax bills arrive.

“I’ve seen 40-year friendships destroyed over beehive arrangements,” says rural mediator David Chen. “Nobody expects a few bee boxes to trigger thousands in tax liability. When it happens, everybody blames everybody else.”

| Typical Tax Scenario | Before Beehives | After Reclassification | Annual Increase |

|---|---|---|---|

| 2-acre residential lot | $1,200 | $3,800 | $2,600 |

| 5-acre unused land | $800 | $4,200 | $3,400 |

| 10-acre family property | $2,100 | $7,500 | $5,400 |

Why Beekeepers Often Walk Away When Trouble Starts

Many beekeepers genuinely believe they’re helping landowners and the environment. However, when tax problems surface, the economic reality becomes clear: the beekeeper has been operating a profitable business while the landowner bears the tax consequences.

Smart beekeepers often have multiple locations and can simply move their hives when disputes arise. They may even claim the arrangement was temporary “storage” rather than active land use. Meanwhile, landowners remain stuck with reclassified property and mounting tax bills.

“The beekeeper can pack up and leave, but you can’t move your land,” notes property tax attorney Sarah Williams. “That’s why landowners need formal agreements specifying who pays additional taxes before any hives get placed.”

Some beekeepers do operate ethically, covering tax increases or providing compensation that makes the arrangement worthwhile. But handshake deals rarely protect landowners when problems develop.

Protecting Your Land and Your Wallet

Smart landowners can still support local beekeeping without risking their financial security. The key lies in proper documentation and clear agreements before any hives arrive.

Essential protections include written contracts specifying tax liability, insurance requirements, and termination procedures. Many successful arrangements involve the beekeeper paying an annual land use fee that covers potential tax increases plus reasonable compensation.

“A good beekeeper who’s serious about business should have no problem signing a proper agreement,” explains rural attorney Mark Thompson. “If they won’t put terms in writing, that’s your red flag to walk away.”

Contact your county assessor’s office before agreeing to any land use arrangement. Many offices will provide preliminary guidance about potential tax implications. Some regions also offer agricultural exemptions that can benefit both parties when properly structured.

Remember that agricultural land tax rules vary significantly by state and county. What seems harmless in one area might trigger major tax consequences elsewhere. Professional consultation often costs less than one year’s unexpected tax increase.

FAQs

Can I let someone place beehives on my property without tax consequences?

It depends on local tax rules and how the operation is structured, but most commercial beekeeping triggers agricultural land use classifications with different tax rates.

What should I do if I already have an informal beehive arrangement?

Contact your county tax assessor immediately to understand your current status, then work with the beekeeper to formalize proper agreements or terminate the arrangement.

Are there ways to support beekeeping without tax risks?

Yes, through properly structured agreements where the beekeeper pays land use fees covering tax increases, or through certified conservation programs that may offer tax benefits.

How do tax authorities discover informal beehive arrangements?

Through aerial surveys, municipal records, neighbor reports, or routine property assessments that reveal commercial agricultural activities.

Can I sue a beekeeper who caused unexpected tax bills?

Potentially, but informal handshake agreements make legal recovery difficult and expensive, which is why written contracts are essential.

Do small hobby beekeepers cause the same tax problems?

Usually not, but the distinction between hobby and commercial beekeeping isn’t always clear to tax authorities, making formal agreements important regardless of scale.